I am feeling rather annoyed with Campbell Newman this month but nothing has gotten me hotter under the collar then all the negative spin about the state of Queensland’s finances and the media are not much better for actually giving this rubbish some sort of credibility.

I would really like to address the following comments Campbell Newman has made recently, keep in mind this is the Premier of the our state saying this bollocks who is meant to talk us up not down for his own political gains;

“We have a $47 billion budget but we have an operating deficit of $2.8 billion”

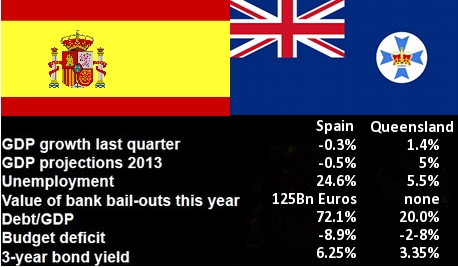

“I’m saying that if we fail to act in a way that we are that Queensland would ultimately be the Spain of Australian states.”

The first part is spot on no question about it, and while it’s not a great place to be it’s also not the soul destroying end of the world tripe the LNP is portraying it to be and we will get to that in just a minute. It’s the second part of these comments that really gets my goat, how any responsible political figure can compare Queensland’s state finances to Spain is beyond me. Not only is it misleading it’s down right dangerous.

So lets compare Queensland’s financial situation to Spain’s for a moment and see if there is any basis of fact in what the Premier is saying.

Oh look there is absolutely no substance to the crap Mr Newman is sprouting… Spain quite clearly has Zero ability to service it’s public debt, has no growth, and unemployment going through the roof.

But lets not just look at Spain, lets take a quick gander at the public levels of debt to GDP ratio’s in other OECD nations;

Japan 208% of GDP

USA 104% of GDP

France 86% of GDP

UK 85% of GDP

Canada 83% of GDP

Germany 82% of GDP

Remind me again what was Queensland’s public debt to GPD ratio?? Oh that’s right 20%… but I want to put that into an every day perspective. The average punter on the street has debt equivalent to 5 to 8 times their annual salary, the Queensland Government has debt equivalent to 1.4 times it’s annual salary. Think of it like this the median average family home in South East Qld is $499,000 and the median salary is $70,000. Today any of the big four bank’s will loan you $436,000 @ 6.86% interest and that’s safely serviceable even though that represents a debt of 3.1 times more than the average dual income ($140k). Add to that then car repayments etc…

The premier would have you believe then the State can’t do what average people do day in and day out. What’s more the State only pays a modest 3.35% in interest. Not only can Queensland comfortably service its debt, but it is paying the kind of interest rates that anyone with a mortgage can only dream of. It’s complete and utter bunkum to compare Queensland to Spain.

My question then to Campbell Newman is then what is an acceptable level of debt? None? but that can’t be right because as Lord Mayor of Brisbane Mr Newman presided over a council deficit 0.6 times its annual income, and that was on the back of receiving over $2bn from Anna Bligh for water assets. Some quick statistics from Mr Newman’s time as Lord Mayor.

Rate rises of 25% in 3 years, well above cpi

Deduction of services year on year

2010-11 Budget Deficit of $1.008bn

2012-13 Budget Deficit of $1.114bn

4.87% of Council revenue for 2009-10 year servicing debt

13.56% of Council revenue for 2010-11 year servicing debt

Interesting how as Lord Mayor Mr Newman couldn’t balance the books even after he cut services and raised rates. Seems hypercritical that he rallies on about the ALP delivering budget deficits when that’s precisely what he did himself in these tough times.

The LNP keep talking about our public debt levels as being some horrific catastrophic event, but they can’t even get the number right, now today our public debt is $65bn, not $85bn , not $100bn… the figures the LNP keep quoting over and over again are projections if nothing changes.

But guess what things naturally change as we quite clearly have seen in the past few years, nothing is set in stone so we need to look at the reasons why our public debt has grown from $21bn in 2004 to $65bn today and what is likely to occur naturally to turn it around.

Queensland has had some stand out events that have impacted our budget and public debt levels, and it wouldn’t matter who was in power be it the LNP or the ALP neither would have had the capacity to change the outcome.

The GFC resulted in a sharp decline in the price of Coal which as most people would know is one of Queensland’s major export commodities and greatly contributes to the states revenue via mining royalties. Prior to the GFC (May 2008) the price of coal was $180 USD per metric ton, today the price of coal ranges from $80 to $90 USD per metric ton. That’s a 50% decrease in revenue for the state. At the same time the property market nose dived equating to $4.2bn in lost Taxation revenue. It should be pointed out economists predicted a natural recovery to a budget surplus by 2015-16.

Add to that during the 2010-2011 Floods, Queensland’s annual coal production lost 15% of it’s total capacity.

Then there are those Floods, and other misfortunes like Cyclone Larry and Yasi. $30bn was wiped off the Queensland GDP as a direct result of the Floods, so bad was it that the Federal Government had to introduce a flood levy to try an help claw back the loss. Yet here we are still running at a deficit of only 2.8% with GDP growth forecast to be 5% in 2013 as things normalise.

While all this has been going on Queensland has faced strong population growth and with it increased demand on infrastructure. Prior to the floods, we didn’t have enough water. During the green drought south east Queensland was on the brink of a water crisis with campaigns such as target 150 in full swing. The state government enacted projects to secure the south east’s water supply, including the dam at Wyaralong and the Gold Coast desalination plant, both of which amounted to $1.202bn alone.

Wyaralong dam just a month after it’s completion was filled to 100% capacity during the 2010-11 floods drastic reducing the effects and damage to the area. Even thought the Gold Coast desalination plant is now moth balled that doesn’t mean it was a waste, it has a capacity to supply 27% of the south east’s water demands and will be reactivated when ever dam levels fall below 60%. Along with this the State took control of water assets in major reforms to secure water delivery.

The council of mayors as chaired by Mr Newman had previously maintained and owned 80% the water network, while blaming the State for poor water management it was they who took water profits and added them to general revenue while allowing the network to degrade. Brisbane city council under Campbell Newman lowered water pressure to dangerous levels despite warnings from fire chefs that this would severely impact on the operation of fire sprinkler and hydrant systems. Every other week we heard of more broken water mains.

We have the newly opened Airport link tunnel that Campbell Newman backed all the way to relieve traffic congestion around Brisbane at a cost to the state of $1.5bn plus the land it occupies. In total $54 billion has been invested in infrastructure over the last four years, including the completion of the Gateway Bridge duplication, the Ted Smout Bridge, stadium developments and the construction of the Queensland Children’s Hospital at South Brisbane. Education has seen a 7% increase in funding and the introduction of prep these are all things that are required to keep pace with our growing population.

Among the many deceptions being bantered around by the LNP is the one about borrowing to pay the wages of public servants, and that the ALP employed too many public servants to begin with. Well lets just look at what the LNP’s own people found, on page 104 of the Commission of Audit’s preliminary report prepared by former federal treasurer Peter Costello, Dr Doug McTaggart and Professor Sandra Harding it states;

“except for health, the increases in all other functions relative to the year 2000 are broadly in line with population growth”.

On one hand they say if the size of the public sector kept pace with population growth in the past decade, employee numbers would be 18,500 fewer than they are today, but then on the other hand they say all area’s other then health maintained that balance and represented natural expected growth. They are saying there are 18,500 extra jobs outside this scope in the health department. So the question is, is that too many?? I note the Audit report never once said they were not needed, or required.

18,500 extra people in Health and interestingly enough Health is a major issue in Queensland? One would think it might be justified if it’s an at risk area and we want to reduce things like the instances of ramping.

Dr McTaggart also said last week that he would dispute the claim Campbell Newman is asserting that Queensland was borrowing funds to pay public service salaries in an Industrial Relations Commission hearing.

Right so if the report is saying all area’s of government kept pace with growth other then health then surely is stands to reason that cutting numbers anywhere but health like they are will have a detrimental effect on services?

December 2011, just prior to the state election Campbell Newman said;

“Well I’m saying that we do need to see over time through attrition a reduction in the overall headcount, but not on front line services which actually in many cases need to go up.”

So Newman was saying front line services had to go up, I would presume Health would fall into this category and as the audit report found their are 18,500 extra people in Health and yet we might still need more to fix it. Fast forward however to 2012 and it’s hack and slash time.

He opposed the ALP’s voluntary separation program, on the basis the 3500 redundancy packages cost too much, but has now sacked 9,000+ public servants with more to come but has not trouble affording to pay those redundancies. Of course though he will just blame the increased budget deficit on the ALP.

Of course sacking public servants is just a political exercise based in ideology, it’s not actually necessary and just harms those that can least afford it’s impacts. At the very least it’s robbing Peter to pay Paul. If each of Campbell’s sacked workers can’t find work, it cost’s taxpayers $10,400,000 every fortnight… on top of that you have the added cost to the Queensland local economy that has a direct effect on State revenue in terms of lost GST.

It’s just moving the numbers from the state ledger to the federal ledger, it does nothing to ease the cost of living on Queenslander’s in fact I would argue it does the direct opposite. Prime example is the NDIS, Newman says at the start of the week that Queenslander’s are sick of the federal government putting their hand into our pockets but then that’s exactly what he puts forward to fund the NDIS a federal levy.

His justification for cutting state services is that they are a duplication of federal services, which just puts more pressure on the federal government to increase expenditure on those area’s to compensate which in turn could lead to higher taxes. Campbell Newman doesn’t really care about our cost of living he just doesn’t want it on his balance sheet and is quite happy to shift it to someone else.

Not once in Campbell Newman’s political life has he ever delivered cuts to the people he has represented, he has a history of increasing costs and reducing services.

I am certainly not saying the ALP did a stellar financial job but an argument could be made they certainly didn’t do a bad one considering the budget is only at a 2.8% deficit… the large blow out in our public debt is easily traced to the floods, increased infrastructure to meet the needs of our growing population, cyclones and the global financial crisis.

These are things no government can ignore no matter who is at the reigns and to suggest other wise just flies in the face of common sense, just look around at the other developed nations doing it a lot harder then we are. I would love to hear Campbell Newman say otherwise.

Even with ratings agency Fitch hinting it will downgrade Queensland’s credit rating again from AA+ to AA doesn’t change the fact that the Queensland Government remains set to benefit billions in royalties from new resources projects in coming years. Fitch’s outlook for the Queensland economy is bizarre, while there are some regional areas that are struggling to recover, overall the Queensland economy’s prospects are extremely good and the pain of natural disasters and the GFC will be in the past.

We have stability as recognised by rating agencies Standand and Poor’s, as well as Moody’s, so 2 out of 3 ain’t bad, our GDP continues to grow as does our productivity. The reserve bank keeping interest rates on hold is good sign of this as well, putting them up means the economy is over cooking and having to drop them means it’s in decline, I like to think keeping them steady and on hold indicates we have turned the corner and are on the incline not the steep nose dive Campbell Newman would have us all believe.

Can Do Campbell need’s to stop the rot and get on with doing what’s in the states best interests, this brand of ideological madness will only lead to ruination. Take heed Australia, Tony Abbott reads from the exact same negativity play book only on a much grander scale.